The Board has overall responsibility for ensuring an effective system of risk management and internal control to be maintained and for reviewing its effectiveness to safeguard the Company’s assets and the shareholders’ interests. The Board always regards risk management as an important task and believes that effective corporate risk management is an essential element of good corporate governance. The Risk Management Committee and Audit Committee have been established under the Board, which are responsible for monitoring and reviewing the risk management and internal control systems of the Group.

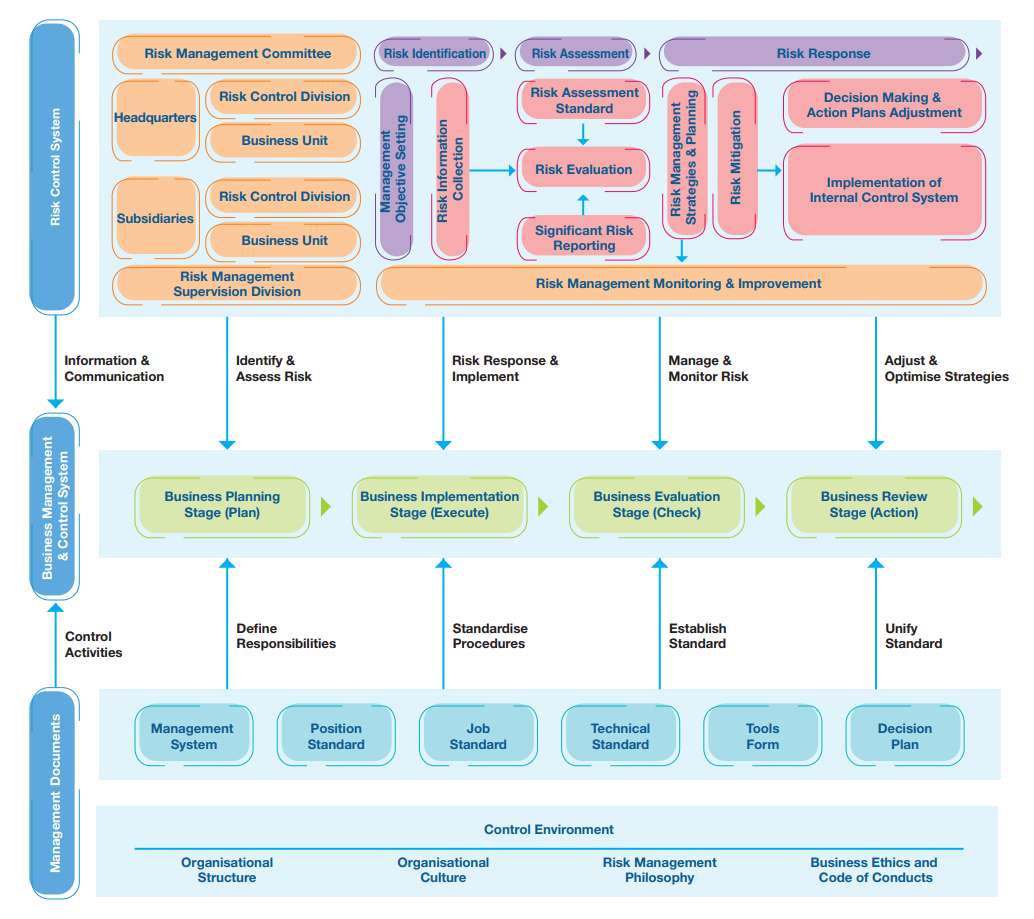

The Group had adopted the risk management framework formulated by the Committee of Sponsoring Organisations of the Treadway Commission in the United States as recommended by the Hong Kong Institute of Certified Public Accountants. The purpose of the Company’s risk management process is to identify and manage risks in such a way that the Company is able to meet its strategic and financial targets.

COSCO SHIPPING International believes that risk management is the responsibility of everyone within the Group. It aims to develop risk awareness and control responsibility as our culture and the foundation of our internal controls system. The internal controls system applies to COSCO SHIPPING International’s critical business processes including strategy development, business planning, investment decisions, capital allocation and day-to-day operations.

Among various COSCO SHIPPING International’s core shipping services business units, control activities have been built on regular top-level reviews, segregation of duties and physical controls. Currently, the key features of the internal controls system include:

- design of an organisational structure with defined lines of responsibility and delegation of authority;

- setup and adherence of authorization and approval limits of the Company and each business unit;

- establishment of policies and procedures to support deployment of management’s directives;

- systems and procedures to identify and mitigate risks on an ongoing basis; and

- application of enterprise resource planning (ERP) systems and other relevant information technology in business processes to strengthen internal controls and promote internal efficiency.

COSCO SHIPPING International seeks to have risk management features embedded in the day-to-day operations. At the beginning of each year, we conduct a risk assessment on the existing or potential risks that may impact the achievement of business objectives over the course of business operation. The assessment includes potential likelihood and impact of the identified risks. For the risks identified, we determine the action plans and management targets. The management of each business unit of COSCO SHIPPING International is responsible for managing their respective day-to- day operating risks, and implementing measures to mitigate such risks.

Internal Audit Department monitors the implementation of risk management, and continuously reviews and assesses the efficiency and adequacy of action plans in regular basis. Such assessment results will be regularly communicated and reported to Risk Management Committee and the Board.

Internal Audit Department performs regular reviews of COSCO SHIPPING International’s internal controls based on the annual audit plan approved by the Audit Committee. The Audit Committee has the final authority to approve the annual audit plan. The Audit Committee assesses the effectiveness of the internal control system by reviewing the work of Internal Audit Department and its findings.

The management of the business units is responsible for ensuring the agreed-upon action plans be implemented within an appropriate timeframe. The management must also confirm annually to Internal Audit Department that business units under their control have taken or are in the process of taking the appropriate actions to deal with all significant recommendations made by external auditor of the Company in management letters or by regulators following regulatory inspections, if any.

The Board has overall responsibility for ensuring an effective system of risk management and internal control to be maintained and for reviewing its effectiveness to safeguard the Company’s assets and the shareholders’ interests. The Board always regards risk management as an important task and believes that effective corporate risk management is an essential element of good corporate governance. The Risk Management Committee and Audit Committee have been established under the Board, which are responsible for monitoring and reviewing the risk management and internal control systems of the Group.

COSCO Shipping International is committed to ensuring that accurate and complete information is disclosed through the Electronic Publication System operated by The Stock Exchange of Hong Kong Limited and the Company’s website, aiming to protect the shareholders’ right to know and balance the interests of the stakeholders.

To foster regular and contribute two-way communications amongst the Company, the shareholders and potential investors, the Investor Relations Department of Public Relations Division of COSCO SHIPPING International is designated to respond to enquiries from the stakeholders. As the bridge between COSCO SHIPPING International and the shareholders and investors, on one hand, we provide up-to-date, accurate and complete corporate information, including the latest operating information, the development strategy of the Company and the industry prospects, for stakeholder and analysts to enhance their understanding of the Company and the industry in which it operates. On the other hand, we gather and handle the concerns, advices and recommendations of stakeholders and analysts to the Company, especially those from the existing shareholders who have been long time holders of the Company’s shares in order to provide valuable references for the management in decision making.

We communicate with the shareholders and investors through the following channels: Q&A sessions during shareholders’ meetings, press conference, analysts meeting, Company’s website, roadshows, investor presentations, corporate collaterals, and by phone or by emails.